FIAs and RILAs are “The Better Bond”

Fixed Indexed Annuities (FIAs) and Registered Index-Linked Annuities (RILAs) are structured products, a specific investment type engineered to meet specific investment needs. A common structured product has a variety of equity, balanced, and risk-controlled indexes to choose a target return along with a desired level of market protection. To compensate for the protection, certain limiters are placed on the index such as capping the amount of index return or gaining only a certain percentage; the more protection desired, the more restrictive the limiters. Because of these limiters, the return profile is more closely aligned with a high-yield (junk) bond, but without the market risk. FIAFIAs/RILAs are similar, but RILAs are registered with the SEC and offer different options for market-decline protection than FIAs. Both FIAs/RILAs are in the same structured product family as market-linked certificates of deposit (MLCDs) issued by banks and buffer ETFs respectively. However, FIAs/RILAs have important structural advantages: tax-deferral; tax-free product exchanges; no maturity; guaranteed income options. And, because the value of the risk protection is a function of the issuer’s financial stability, insurance companies shine as a guarantor because of their high capitalization rate and stringent regulatory oversight.

What You Need to Know

Avoid Tax and Market Losses for Accelerated Portfolio Growth

When you avoid losses in your portfolio from taxes and market declines, your portfolio compounds from a higher base

Integrate FIAs/RILAs into a Portfolio for Improved Return and Lower Risk

FIAs’/RILAs’ loss protection and attractive returns boost portfolio values and support higher allocations to growth investments

Receive Insurance Company Guarantees for Secured Protection from Market Loss

Insurance companies are highly regulated and well capitalized that make the guaranteed protection secure

Key Metrics

-

- Nearly $750 B in placements

- Over $100 B per year in new investments

- Over 30 top-rated providers

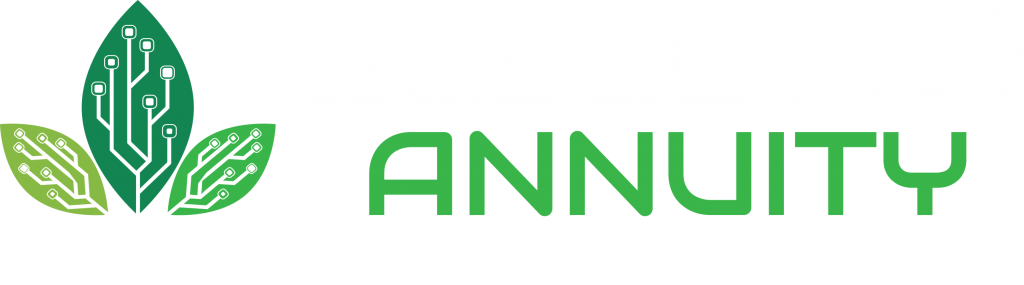

Bond ETFs/MFs Can Suffer Losses

When you invest in a bond ETF or mutual fund (MF), you own shares in a large pool of bonds but not the bonds themselves. As an investor, you share proportionally in the total income but are subject to interest rate changes. When interest rates decline, the value of the bonds in the pool increases because investors are willing to pay more to get a higher coupon payment, but when interest rates rise, the bondholder has to make up the difference in a bond’s lower coupon. They do so by selling for a lower amount than the bond is worth. In a bond ETF/MF, your portfolio value rises and falls with these interest rate changes; there is total-return risk.

With the Fed’s dramatic interest rate increases to counteract inflation, ETF and MF bond portfolio values have declined dramatically.

How FIAs/RILAs Work

High-Quality Zero Coupon Bonds + Options to a Target Index

Investor: Selects one or more indexes

You pick one or more indexes from an available set. These indexes can be equity-based like the S&P 500, focused on balanced market exposure, or risk controlled.

Key Fact: The S&P 500 is the most popular index selected, but FIA/RILA products offer a wide range of indexes to choose from; indexes perform differently depending on the market selections so a portfolio of indexes inside the product has the most resilient return profile.

Insurance company: Buys zero-coupon bonds

Unlike a standard bond that pays interest semi-annually, a zero-coupon bond does not pay interest. Instead, the bond is sold at a discount to the par value (e.g., $1,000); the discount equals the current interest rate when the bond matures.

Key Fact: Zero-coupon bonds are issued by the US government, corporations, and municipalities.

Insurance company: Buys options on the target index

The amount left over from buying the bonds at a discount is used to buy a mix of puts and calls on the target index. (A put protects when the index declines in value; a call takes advantage when it rises.) Options allow participation in the index’s return without owning it.

Key Fact: Trading in options exceeds trading in stocks; options exist for stocks and ETFs.

Insurance company: Restricts performance

Since there is a guaranteed floor, the insurance company wants to limit its risk. Indexes with high volatility like the S&P 500 are harder to protect than indexes that are balanced or risk controlled. To adjust the risk, the insurance company puts limits on the amount of the target index’s return to be earned.

Key Fact: Return limiters to the target index lead to performance most aligned with junk bonds but without the risk.

Past Gains are Guaranteed

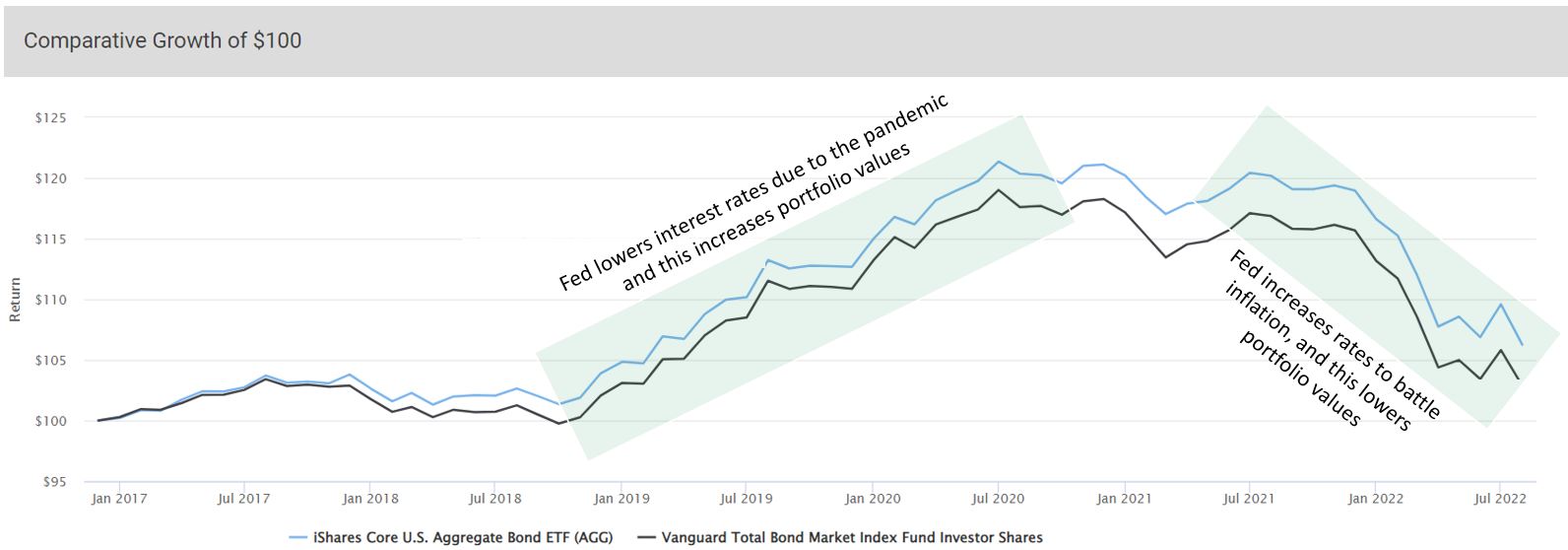

Structured products put limiters on the target index. These limiters typically set a cap or specify a certain percentage in the index’s return. For example, a cap of 5% limits the amount of return to this cap even though the target index is greater. A participation rate of 75% limits the credited amount of an index’s 10% return to 7.5%. Generally, these limiters lead to FIA/RILA return profiles between intermediate and high-yield bonds, but losses are protected.

But unlike the iShares aggregate bond ETF (AGG) or the Vanguard Total Bond Market fund, FIA’s/RILA’s previous gains are not lost because of rising interest rates; there is no total-return risk.

An FIA’s/RILA’s structure pays a return at specified intervals (e.g., annually is most common) tied to an index (e.g., S&P 500) or a portfolio of indexes.

In the example below, an FIA’s target index is the S&P 500. In 2018 and 2022 (year to date as of July), the S&P 500 suffered market losses, but the FIA’s guaranteed floor kept the value the same as the year before. When the S&P 500 rose in 2017, 2019, 2020, and 2021, the structured participation to the S&P’s return was credited to the account and the value was booked. This became a new guaranteed floor.

A New Floor is Set Each Time Return is Credited

Powerful Tax Benefits

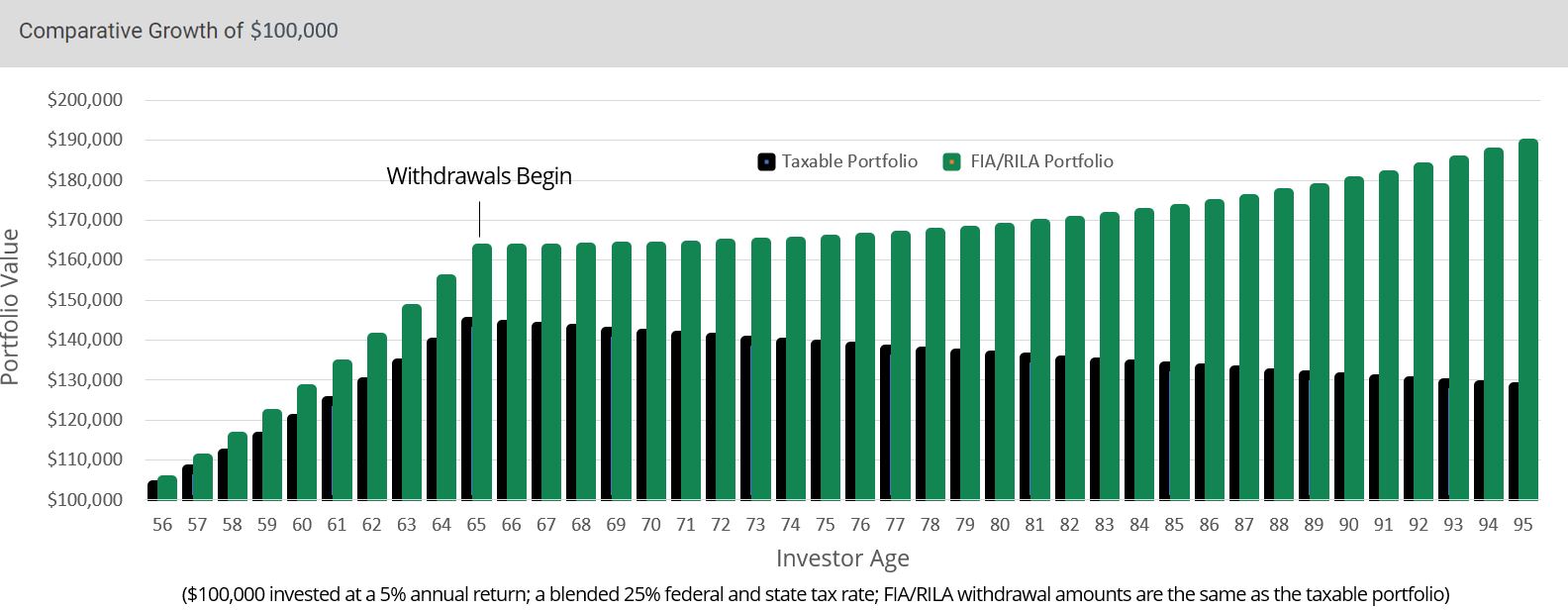

A taxable portfolio is hit with reduced return each year when federal and state taxes are paid. For high net worth investors, the blended federal/state marginal rate can exceed 50% in high-tax states. If an investor is at this 50% marginal rate, a 10% annual return is reduced to a net of 5%, and this lower return is the amount that compounds.

When taxes are deferred in an FIA/RILA, the tax amount that otherwise would be paid is compounded inside the portfolio (i.e., 10% in the above example instead of the after-tax 5%). This produces accelerated returns.

Unlike other structured products, the tax code provides full tax deferral on FIAs/RILAs. When money is withdrawn from an FIA/RILA, the growth in the portfolio is taxed at income tax rates (the initial amount contributed is not taxed). Importantly, the remaining value in the FIA/RILA continues to grow tax-deferred until death. Conversely, while a withdrawal from a taxable portfolio is not taxed again, the remaining portfolio’s annual income and realized gains are still taxed, and this continues to negatively impact the portfolio’s value

Buffer ETFs allow the value at maturity to be rolled over into a new buffer ETF investment with deferral of the capital gains taxes. In contrast to FIAs/RILAs, the entire investment must be rolled over to maintain deferral; any partial withdrawal is taxed.

(Note: Market-linked CDs and other structured notes have no tax deferral. A return is paid only at maturity, but any credited return prior to maturity is still taxed annually. Since no money is paid until maturity, the taxes due along the way must be paid from other sources.)

Compounding Tax Savings Results in Accelerated Returns

Tax-Free Exchanges to Other Annuities

Convert to Guaranteed Income without Taxes Due

FIAs/RILAs, as insurance products, are unique among structured products for their ability to convert portfolio value into guaranteed income without incurring any tax consequences.

First, as presented above, FIA/RILA portfolio values are higher than a comparable taxable portfolio because of the compounded tax savings achieved by FIA’s/RILA’s tax deferral as well as not suffering market losses.

Second, because the tax code permits tax-free exchanges from one annuity product to another, this higher portfolio value can be converted to a guaranteed lifetime income annuity without paying any of the deferred taxes to do so.

For example, at the onset of retirement, an investor can convert all or a portion of the FIA/RILA value to a single premium immediate annuity. The insurance company will base the income amount on the FIA’s/RILA’s accumulated value.

Third, it’s not necessary that this conversion be done all at once. For example, it may be desirable to convert only a portion of the FIA/RILA to guaranteed income to fill an income gap and keep the remainder growing tax deferred. (Note: unlike tax-deferred retirement products, FIAs/RILAs do not require age-based minimum distributions.)

Eliminate Issuer Risk with Obsolete Products

Investors are protected from obsolete products by exchanging to another insurance company’s FIA/RILA tax-free.

FIAs/RILAs can be held until death while keeping their structural advantages of tax deferral and market-loss protection.

Given this long-term role, insurance companies’ FIA/RILA products that do not maintain competitive performance profiles because of more severe index limiters or failing to include new innovations can be replaced tax-free.

The compounded tax deferral built up since the initial contribution in the first FIA/RILA remains intact when an exchange is made to a new FIA/RILA. In other words, there are no taxes due, and the tax-deferral continues. (Note: buffer ETFs’ capital gains tax-deferral applies only when a rollover balance is made to the same product ticker; rolling over to another ticker will require payment of the deferred taxes.)

Portfolio Integration Strength

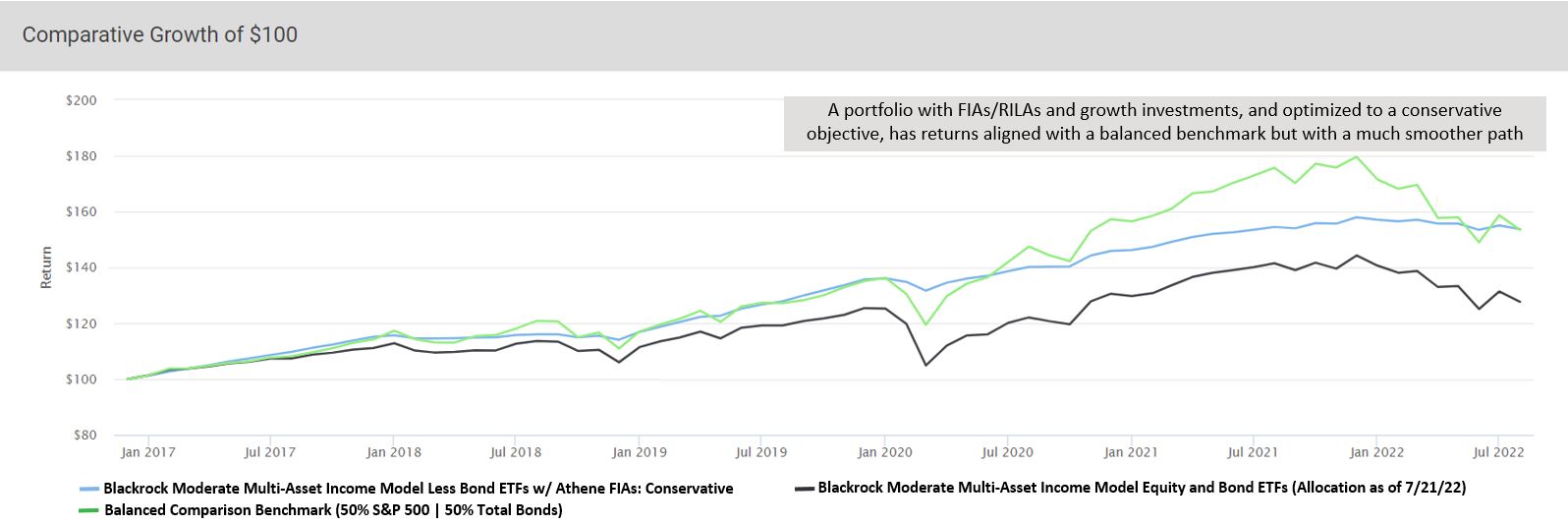

This analysis uses one of BlackRock’s iShare ETF portfolios. The portfolio is a mix of equities and bonds as well as US and non-US. The model used for this analysis employs a “moderate” risk profile with the allocation made in July 2022.

The FIA/RILA comparison keeps the BlackRock equity ETFs (US and non-US) but replaces the bond ETFs with a mix of five indexes from Athene’s FIA Accumax and Accumulator products; each crediting strategy has a 5-year surrender. The allocated mix of indexes includes the S&P 500, balanced, and risk-controlled. The ETF/FIA portfolio is algorithmically optimized to a conservative investment objective.

Allocating to “The Better Bond” produces enhanced portfolio returns with substantially lower risk. These are portfolio characteristics sustainable for the long term regardless of the interest-rate environment.

Comparing a Standard Portfolio with and without FIAs/RILAs

The Return Profile

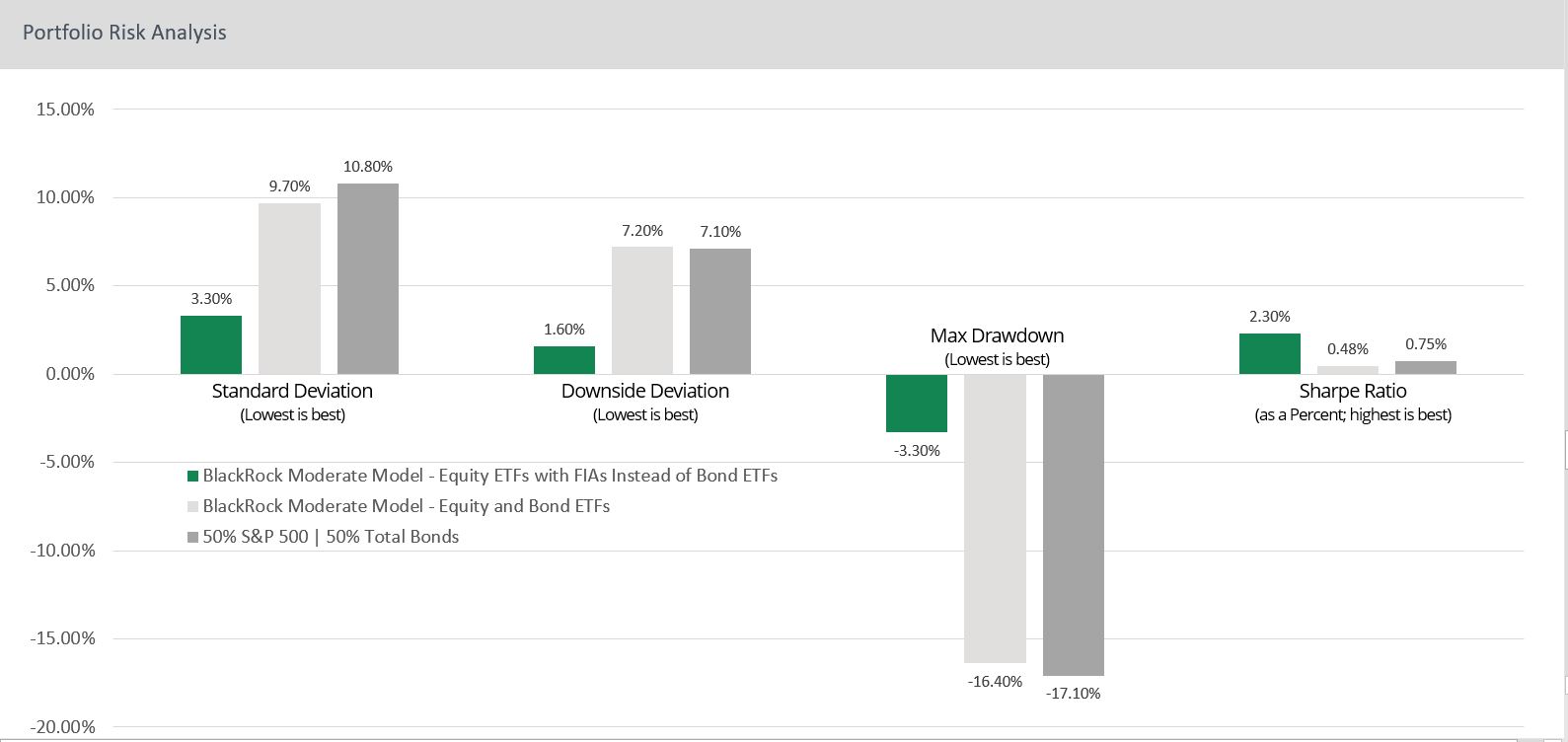

The Risk Profile

(Standard Deviation: the variability of each data point above or below the mean); (Downside Deviation: the amount of variability below a minimum amount or return); (Max Drawdown: the maximum loss within the market’s top to bottom); (Sharpe Ratio: the amount of return per unit of risk above a risk-free rate. Ratios >1.0 provides more return compensation for risk)

Asset Allocation with The Better Bond

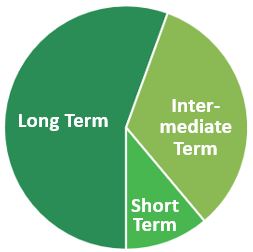

Horizon allocations are target periods that maintain the same time definitions regardless of the current year; each horizon rolls forward one year as the current year ends; a common allocation across these horizons is 60% long-term, 30% intermediate, and 10% short-term

Short-Term Horizon

The short term – current year to 3 years – emphasizes cash; for working investors, this will primarily be compensation; for retired investors, cash will be sourced by retirement income, portfolio income, and realized capital gains, all of which must have low volatility to ensure when bills are due there is cash to pay; instead of short-term bonds that are subject to market declines, consider buffer ETFs since they are similar to FIAs/RILAs

The Better Bond:

the Intermediate Horizon

The intermediate term – 3 years to 10 years – is the bridge between growth in the long term and cash and equivalents in the short term; this is the place for The Better Bond with returns higher than traditional bonds while protecting against taxes and market losses; at the retirement transition, the FIA/RILA balance can be converted to guaranteed income tax-free

Long-Term Horizon

The long-term horizon is, typically, 10 years and forward; this time period allows the ups and downs of the market to naturally smooth, making it ideal for growth investments with high year-to-year volatility; this horizon’s growth objective is the engine to overcome the impact of inflation on purchasing power; higher growth also gives a cushion to overcome estimation errors forecasting longevity and anticipated wealth transfers

FIA/RILA Annual Portfolio Rebalancing Flexibility

While FIAs/RILAs do not have a maturity, insurance companies have surrender charges for specific time frames. (Surrender charges allow an insurance company to recoup its sales expenses should an FIA/RILA contract terminate early; ending a contract is costly and should be avoided.) The length of surrender is trending to fewer years, and the bulk of products have 5- to 7-year terms.

From a planning standpoint, it’s straightforward to not allocate to FIAs/RILAs with surrender periods beyond the time-horizon window (i.e., the intermediate rolling 3- to 10-year forward period).

Even so, most FIAs/RILAs offer a “free” withdrawal per year without triggering surrender charges, typically 10% of the initial contribution. This permits more than sufficient liquidity for rebalancing from the intermediate horizon to the short-term horizon should a new investment objective dictate investment reallocation or cash flow is needed. And, since this withdrawal is coming from the initial invested amount, it is not taxed.

After the surrender period, investments can remain in the product until death.

Benefits of Structure and Math

Avoiding Wealth Leakages is a High-Impact Achievement

Taxes on portfolio returns take more from wealth than market declines – and this happens every year – but is less visible because most performance reports don’t show the lower after-tax return.

It is clear, though, that minimizing portfolio leakages from market declines and taxes are two top achievements for any portfolio.

Avoiding losing dollars makes a wealth plan more viable and secure with substantially reduced anxiety. This outcome is simply due to the math behind compounding.

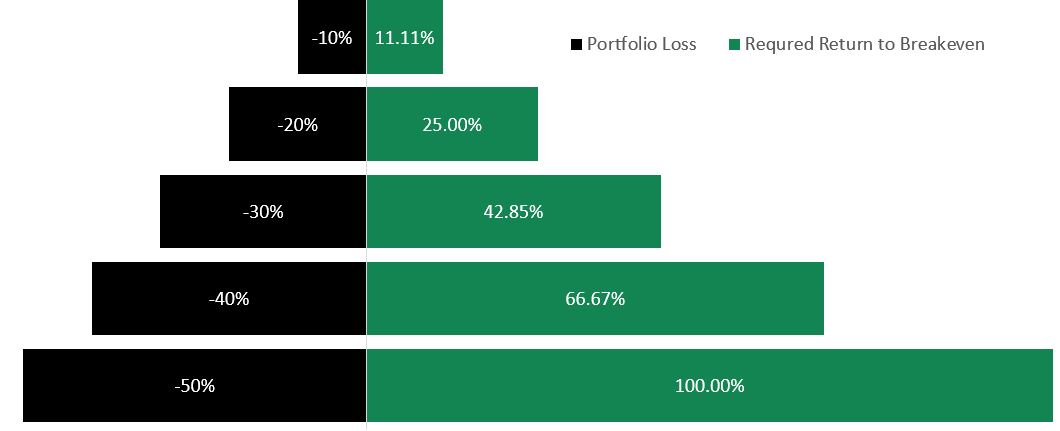

A dollar not lost and remaining in the portfolio allows the portfolio to compound from a higher floor when investments increase in value. While people understand this acceleration, it is often not realized that losing a compounded dollar leads to accelerating losses such that to recover these losses requires the portfolio to earn a percentage return higher than than what was lost.

FIAs/RILAs prevent these declines with guaranteed floors and tax deferral.

These structures allow compounding math to accelerate growth without the friction of overcoming losses.

Required Return to Make Up for Losses

Key Takeaways for “The Better Bond”

Unlike bond ETFs/MFs, FIAs/RILAs do not have total-return risk; this not only has economic value but it reduces anxiety during uncertain times

Avoiding tax and market losses allow the portfolio to compound from a higher floor, and this increases long-term portfolio value