A Massive – but Neglected – Market.

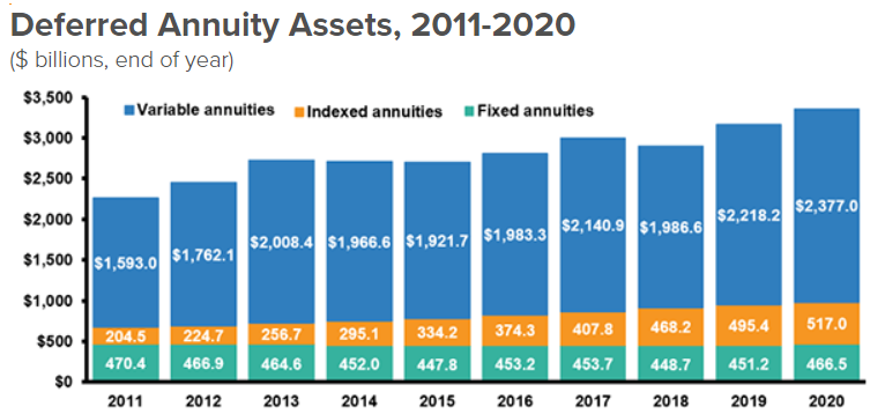

Nearly $3 Trillion in Neglected Assets

Source: https://www.iii.org/fact-statistic/facts-statistics-annuities

Neglect Caps Effectiveness

Nearly $3 trillion in individual wealth is represented by FIAs, RILAs, and VAs. This is sticky money because of built-in structures such as surrender charges, guarantees, and tax deferral.

These products all have a portfolio management component: For FIAs/RILAs, it’s the exposure to the package of available indexes; for VAs, it’s the allocation to available insurance company sub-accounts of registered mutual-fund-like products (often numbering in the hundreds).

Although FIAs/RILAs/VAs are investments by every definition of that word, they suffer from point-of-sale and post-sale neglect. At the time of funding, no investment performance analytics or optimization are applied; after the sale, rarely is the investment structure adjusted in light of product changes, annuity advancements, changing investment markets, evolving needs, revised objectives, and/or adjusted planning horizons.

Strong Sales Growth

RILAs

“Registered index-linked annuity (RILA) sales broke records in the fourth quarter and for the year. Fourth-quarter RILA sales were $10.6 billion, 26% higher than the prior year. In 2021, RILA sales were $39 billion, 62% higher than the prior year.”

“In 2021, RILA sales benefited from current economic conditions and expanded competition as new carriers enter the market,” noted Giesing. “SRI predicts investors will continue to seek solutions that offer a balance of protection and growth — which these products offer — in 2022, continuing RILA sales’ upward trajectory.”

FIAs

“Fixed indexed annuity (FIA) sales were $16.6 billion, an 18% increase from fourth quarter 2020. FIA sales were $63.7 billion in 2021, up 15% from the prior year. This marks the largest annual growth for FIA products in three years.”

“Improved interest rates and product innovation around cap rates helped address the pricing challenges FIA carriers faced early in 2021, making the products more attractive to investors,” Giesing said. “In addition, we see growing interest in accumulation-focused FIA products, as investors seek principal protection with greater investment growth to offset rising inflation.”

VAs

“Traditional VA sales were $21.7 billion in the fourth quarter [of 2021], a 13% increase from fourth quarter 2020. For the year, traditional VA sales totaled $86.6 billion, up 16% from the prior year. This ends nine years of declines for traditional VA sales.”

“We have not seen traditional VA sales growth at this level in over a decade. Heightened concern about potential changes to the tax code drove growth in investment-focused, non-qualified product sales,” said Giesing. “In 2021, fee-based products experienced the largest gains as registered investment advisors and broker-dealers sought out tax-deferral solutions for their clients.”

Stuck at the Start

For all the criticism annuities receive from advisors, annuities are increasingly a core retirement income vehicle with complementary benefits to standard investment allocations.

There is steady year-over-year sales growth, and each new sale locks in client assets for years to come.

Yet, with the structural opportunities of tax-deferred portfolio growth, guaranteed income, and estate benefits, these new assets will be poorly used within a client’s financial and investment plan.

Advisors often allocate annuity money based on brand and rules-of-thumb. The trillions of dollars at hand, and reliance on annuity income, demand intelligent tools, informed decisions, and active investment management.

Source: https://www.limra.com/en/newsroom/news-releases/2022/secure-retirement-institute-total-annuity-sales-jump-16-in-2021–marking-highest-sales-since-2008/#:~:text=27%2C%202022%E2%80%94Total%20U.S.%20annuity,U.S.%20Individual%20Annuity%20Sales%20Survey.

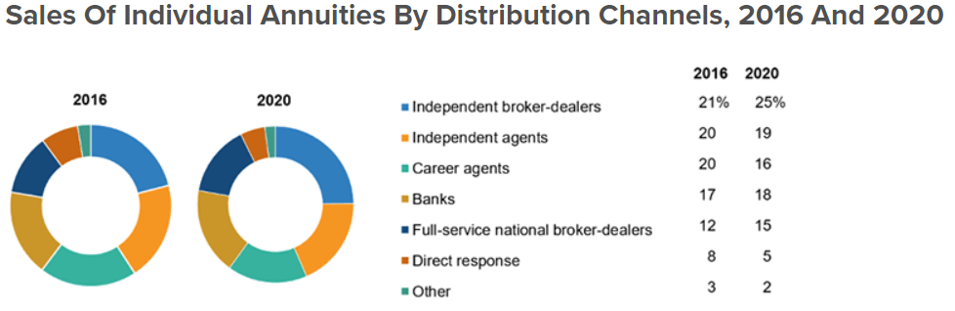

Fragmented Distribution

Source: https://www.iii.org/fact-statistic/facts-statistics-annuities

Add Value and Be in Charge

It’s common for affluent investors – those with the discretionary investment capacity to invest in annuities – to have multiple advisors. An investor can have a fee-only advisor for planning and active investments, a banker for cash management and loans, an attorney for estate planning, an accountant for tax management, and an insurance agent for risk protection.

Annuities can be invested through many of these resources and that doesn’t include DIY.

Deferred annuities are sticky assets. Neglecting the ongoing investment allocation decisions within the annuity is rampant. While this could be indicative of the transactional nature of some distribution channels, it’s more that investment tools are unavailable for understanding complexities, comparing choices, integrating investments, and managing actively.

Certainly, Reg BI and its Care Obligation are shining a light on these failures, but, equally important, the move to integrative planning demands annuities be treated with the same attention and expertise as found with mutual funds, ETFs, stocks, and bonds.