Better Standard Portfolios.

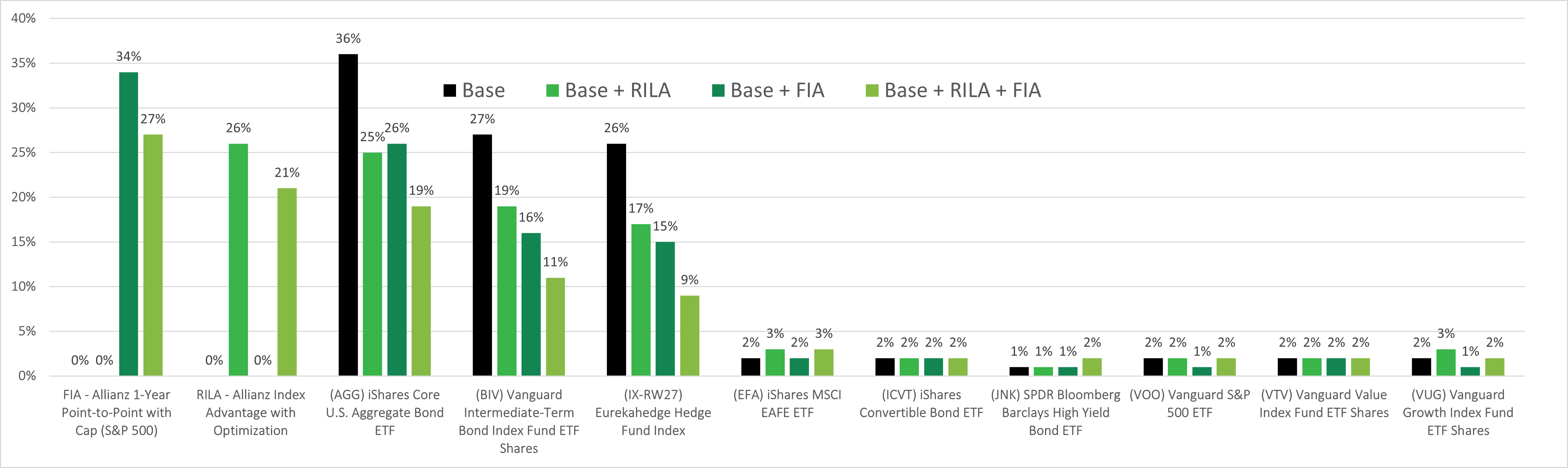

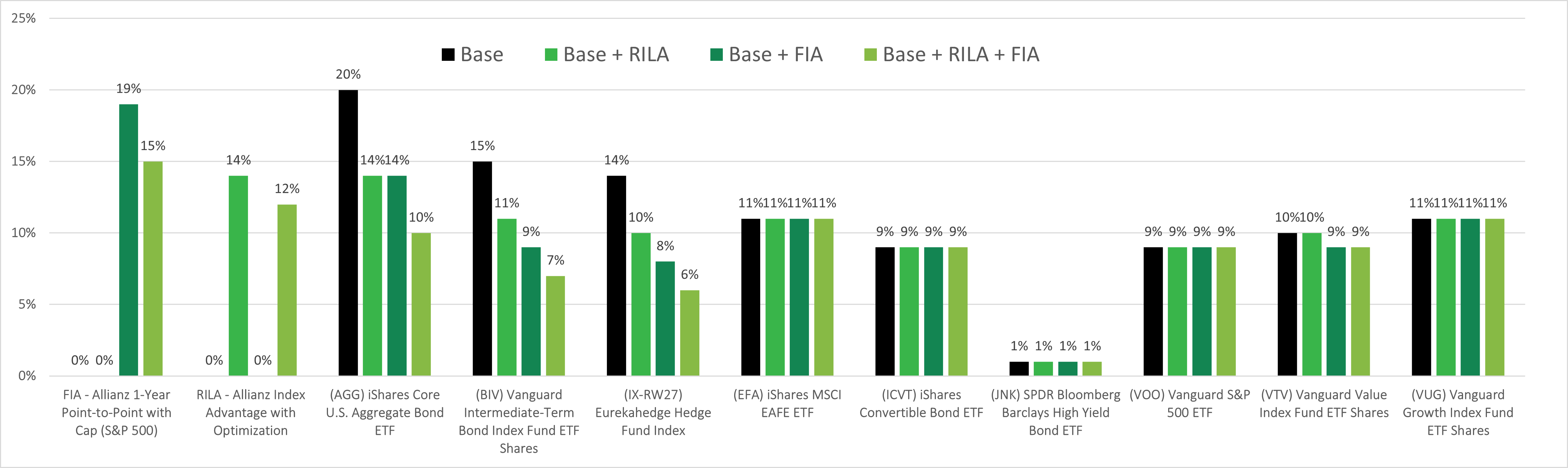

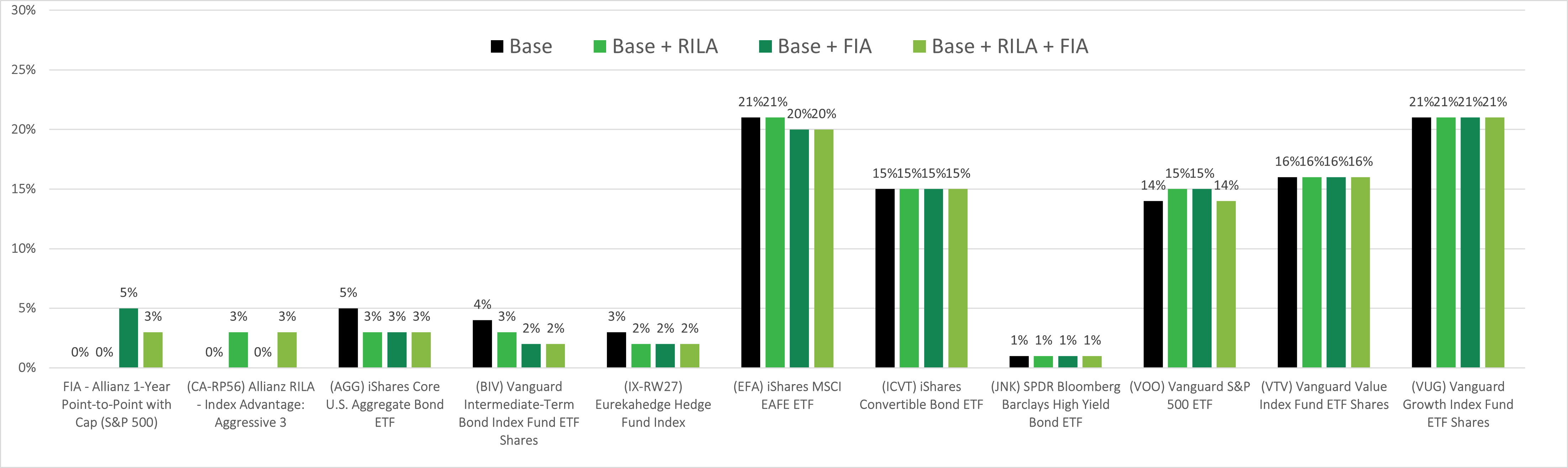

Say a client’s standard portfolio is exposed to nine different asset classes: 1) the broad bond market (represented by the AGG ETF); 2) intermediate bonds (BIV); 3) convertible bonds (ICVT); 4) high yield bonds (JNK); 5) S&P 500 (VOO); 6) value stocks (VTV); 7) growth stocks (VUG); 8) non-US stocks (EFA) and 9) hedge funds (represented by the Eureka hedge fund index).

Next, a client’s investment objective – conservative; balanced; aggressive – dictates the optimization across these asset classes.

Since there isn’t an FIA or RILA industry benchmark, an Allianz Life Insurance Company of North America FIA (Core Income 7; S&P with cap; 1-year point-to-point; 7-year surrender) and RILA (Index Advantage; S&P 500; 1-year point-to-point; 10% buffer; 6-year surrender) are used as proxies.

Integrating an FIA or a RILA adds important risk-adjusted return benefits, chiefly by protecting against losses. Important for asset allocation, an FIA mostly mirrors traditional fixed income metrics but without downside exposure. A RILA, with less downside protection but a higher upside to the target index, fits tightly to a balanced mandate.

And, don’t forget, when FIA/RILA returns are shown, the actual result is even better when the pre-tax equivalent adjustment is made (i.e., return/(1-combined federal and state tax rate)).

Optimized Allocations Shift from Fixed Income to FIAs and RILAs

The conclusion is clear. With optimized conservative and balanced investment objectives, integrating either an FIA, RILA, or both adds substantial risk/adjusted value to portfolios by reducing allocations to fixed income. (FIAs/RILAs have a more muted impact with an aggressive objective because of higher allocations to stocks and little concern for volatility management.)

Select{e}Annuity optimizes using a smart algorithm that considers relative return and volatility on a period-by-period basis. As the algorithm learns from historical market movements, each investment is weighted objectively. FIA and RILA structural benefits prove to be valuable for conservative and balanced investment mandates.

The shift from fixed income to a downside-protected FIA and/or RILA is particularly important in a rising-rate environment since each time a return is credited, a new floor is set that locks in gains.

(Click on each investment objective button below to see the analytical presentation for each investment objective. The summarized allocation shifts are shown in the associated graph.)

The black columns are the optimized allocations across nine asset classes for a “conservative” investment objective. The addition of a RILA optimizes to a reallocation of 26% (the bright-green RILA column, the second set from the left) taken away from core bonds (36% to 25%), intermediate bonds (27% to 19%), and hedge funds (26% to 17%). The greatest reallocation occurs when both an FIA and RILA are added to the core portfolio’s nine asset classes (i.e., a total of 11 investments): core bonds are reduced to 19%, intermediate bonds to 11%, and hedge funds 9%. This optimization reflects FIAs’/RILAs’ downside protection that is especially important with a low-volatility investment objective.

A balanced investment objective seeks volatility management and growth in equal measure. Again, the optimizer reallocates the most with the core portfolio’s addition of both an FIA and RILA: aggregate bonds, intermediate bonds, and hedge funds all have the base allocations cut by at least 50% with the combination of the FIA and RILA receiving a total of 27% (15% and 12% respectively in the two column sets to the left). A balanced optimization benefits with downside protection while allowing the portfolio’s growth portion (i.e., stocks) to seek return.

The smart algorithm doing the optimization is objective. For an “aggressive” portfolio seeking growth, there’s little worry about downside protection and full exposure to the market’s upside is sought. Here, an FIA and RILA receive trivial allocations.

Better Retirement Portfolios.

Superior Target-Date Risk-Adjusted Performance with an FIA and RILA

Target date funds have become a popular selection for retirement plans as they package stock and bond allocations within a specified retirement horizon.

The issue with these allocations is all investment selections are exposed to downside market volatility. An investor with a target retirement date in 2030 still risks market declines in the years just before retirement (i.e., called “sequence-of-return risk”). Most people feel that bond allocations are “safe”, but this is only true when holding individual bonds. In a managed bond portfolio such as an ETF or a mutual fund, every investor is exposed to the risk of loss in a rising rate environment. Why? First, these funds are actively managed and the portfolio manager trades in and out of bonds prior to bonds’ maturity. Second, because of outflows, the portfolio manager must trade bonds prior to maturity to generate liquidity. These actions impact all investors.

Here’s the key for much stronger risk-adjusted performance.

Instead of a preferred target date fund’s bond investments, use an FIA and a RILA to generate substantially improved risk-adjusted performance when optimized to either a conservative or balanced investment objective. In this case, the ETF stock selections in the target-date fund remain the same, but the Select{e}Annuity optimizer smartly allocates objectively across all four components (i.e., two stock ETFs, one FIA, and one RILA).

The FIA and RILA protect when the market declines and mitigate sequence-of-return risk. This is a vital structural advantage since the FIA and RILA lock in the gains and a new floor is set (i.e., protecting against loss) each time return is credited.

When the client investor nears retirement, the modified target-date portfolio’s balance can be converted to an immediate annuity to produce pension-plan-like income. This allows the taxable portfolio to be more aggressively allocated to address longevity and purchasing power risks.

(Click on the “Side-by-Side” buttons below to see two different comparisons of the Vanguard Target Retirement 2030 Fund (VTHRX) with two separate portfolios using the same stock investments but swapping an FIA and RILA for the bond investments.)

Evolving Retirement Model Study

[Quoted Excerpts]

The overwhelming majority of employers (91%) offer a target date fund (TDF) in their defined contribution plans, and 83% say that a TDF is the default investment option in their plans. Despite the prevalence of TDF offerings, many workers and retirees do not understand some TDF basics.

For example:

- Only about half know that TDFs are made up of stocks, bonds and other types of investments (51%), and that the funds typically become more conservative the closer one gets to retirement (50%).

- Fewer than half (46%) know that the “target date” in a TDF refers to the approximate year in which the individual investing in the fund would expect to retire.

- Only about four in 10 know that investing in a TDF does not guarantee enough money to meet income needs in retirement (41%); that money in a TDF can lose value (40%); and, that not all TDFs with the same “target date” follow identical strategies (39%).

- Only about a third (35%) know that investing in a TDF does not ensure one’s ability to retire at the target date. However, despite a lack of full understanding of how TDFs work, a majority of those invested in TDFs (91%, including 92% of employed and 83%18 of retired individuals) believe that their TDFs are helping, or helped them prepare for a secure retirement.

Nearly six in 10 employers (59%) believe TDFs should include an allocation to a capital preservation option such as stable value to protect a portion of participants’ savings. The addition of a capital preservation option such as stable value to TDFs could prove prudent, considering that more than two in five workers are either cautious (35%) or completely avoid taking any risk with their investments (9%).

Additionally, employees are interested in options to preserve their savings. Eight in 10 employees (80%) say they would be interested in a TDF in which, at or near retirement, at least some portion of their money would be guaranteed not to lose value, regardless of how financial markets perform.

For the target-date fund comparison, the image below illustrates how Select{e}Annuity can package certain analytical segments (we call them widgets) for focused purposes. This packaging can be for advisors, client reporting, combo web pages and .pdf reports, and so forth. Select{e}Annuity’s analytical platform reveals insights that would otherwise be overlooked as is the case here when evaluating retirement options.

(Click the image to open it and then click again to zoom.)