Excelling in Risk-Adjusted Returns.

FIAs and RILAs Dominate in 3 Key Portfolio Principles

Two substantial sources of portfolio leakages are taxes and market losses.

Each dollar lost loses its compounding power to produce future value.

A dollar not lost allows the portfolio to compound from a higher floor.

Portfolio Integration Strength.

Comparing a Standard Portfolio with and without FIAs/RILAs

FIAs/RILAs are investments in every meaning of the term. They produce a return from market exposures and emphasize protection against market declines.

In this way, FIA/RILA products’ structures address the two core investment motivations: 1) “fear”, in providing protection when markets decline, and 2) “greed” having an upside when markets rise.

FIAs/RILAs deliver on their promise and markedly improve a portfolio’s risk/adjusted returns (e.g., see the Sharpe Ratio; Sortino Ratio; Calmar Ratio) based on a client’s investment objective. A “conservative” investment objective weights toward fear, but still with exposure to some “greed”; an “aggressive” objective weights toward “greed”; a “balanced” objective seeks an equal measure.

Because FIA’s/RILA’s structural weight is protecting when markets decline, the portfolio impact is highest with a “conservative” investment objective, then impactful with “balanced”, and modest with an “aggressive” objective.

(Click the button below to see how a standard portfolio with nine asset classes substantially improves its risk/adjusted returns with the use of FIAs/RILAs when applied in conservative and balanced investment objectives.)

Plus Tax Deferral.

Compounding Tax Savings Enhances Returns

A key FIA/RILA difference with an investment in a taxable portfolio is the structural (and tax-code legislated) tax deferral until withdrawals begin some years down the road. For true comparison purposes, the FIA/RILA return must be adjusted as a pre-tax equivalent. For example, if a client’s current federal/state tax rate is 50% and an FIA/RILA returns 4%, the pre-tax equivalent return is 8% (i.e., 4%/(1-50%)).

As the tax savings compound over time, the portfolio’s value increases. Most FIAs and RILAs can then be converted tax free to a guaranteed income annuity. This will lock in the higher balance for lifetime income when the investor client’s tax rate is commonly less in the withdrawal stage versus the accumulation stage.

For FIA and/or RILA allocations in a portfolio, when returns are shown, remember that the FIA and RILA returns are even higher if adjusted to the pre-tax equivalent

Plus Gains Are Permanently Booked.

A New Floor is Set Each Time Return is Credited

An FIA’s and RILA’s structure pays a return tied to an index (e.g., S&P 500) at specified intervals (e.g., annually). When a return is credited, a new floor is set, and this locks in the past’s gains. (If there was a market loss during the interval, then the previous floor remains.)

In contrast, a managed fixed income product (e.g., an ETF such as the intermediate bonds) may have achieved attractive returns but negative market forces can take back some or all of the gains. Only individual bonds held to maturity protect the principal from market declines.

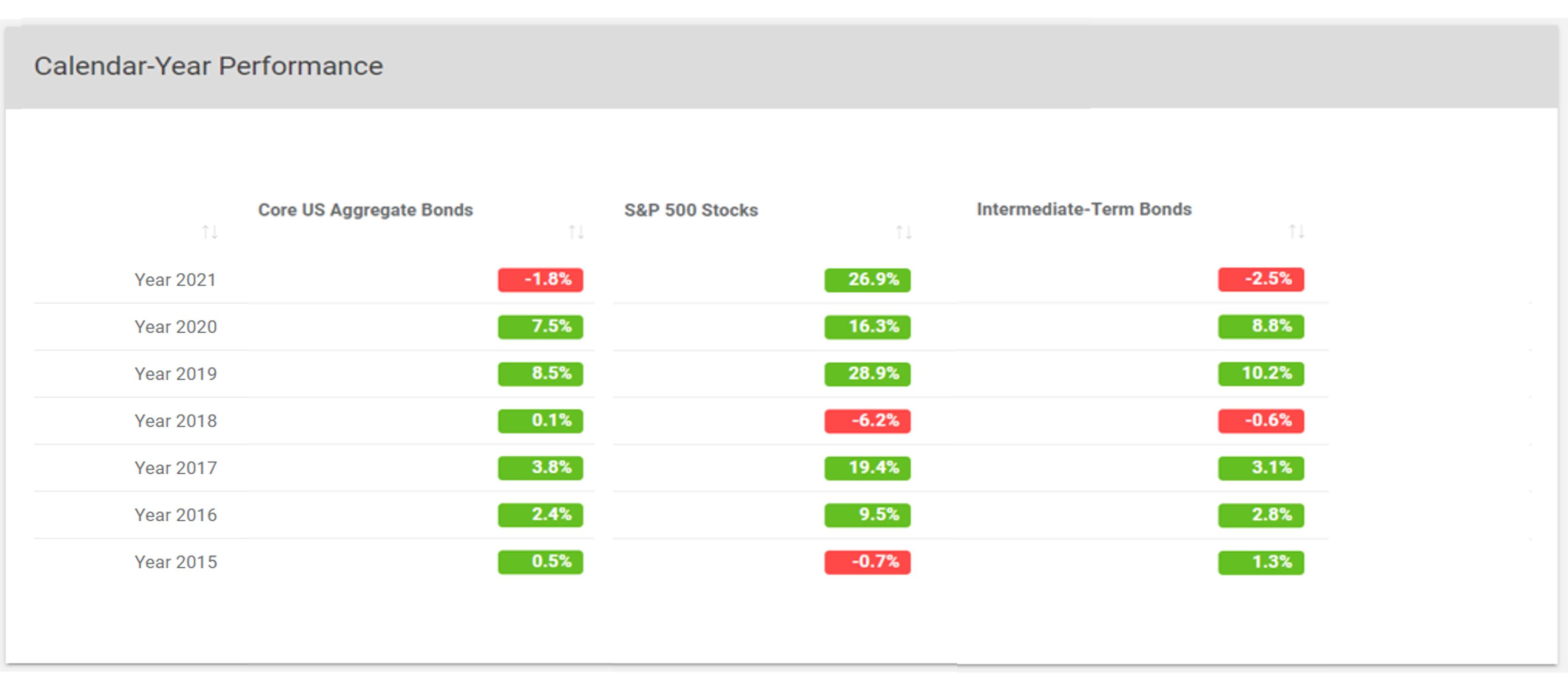

The chart below shows the calendar-year pattern of the aggregate bond market, the S&P 500 (the linked index), and intermediate bonds. 2015 and 2018 were negative years for the S&P 500 (shown above as “[Market Loss]”) whereas the bond market rose and fell as indicated in the intermediate bond index performance line.